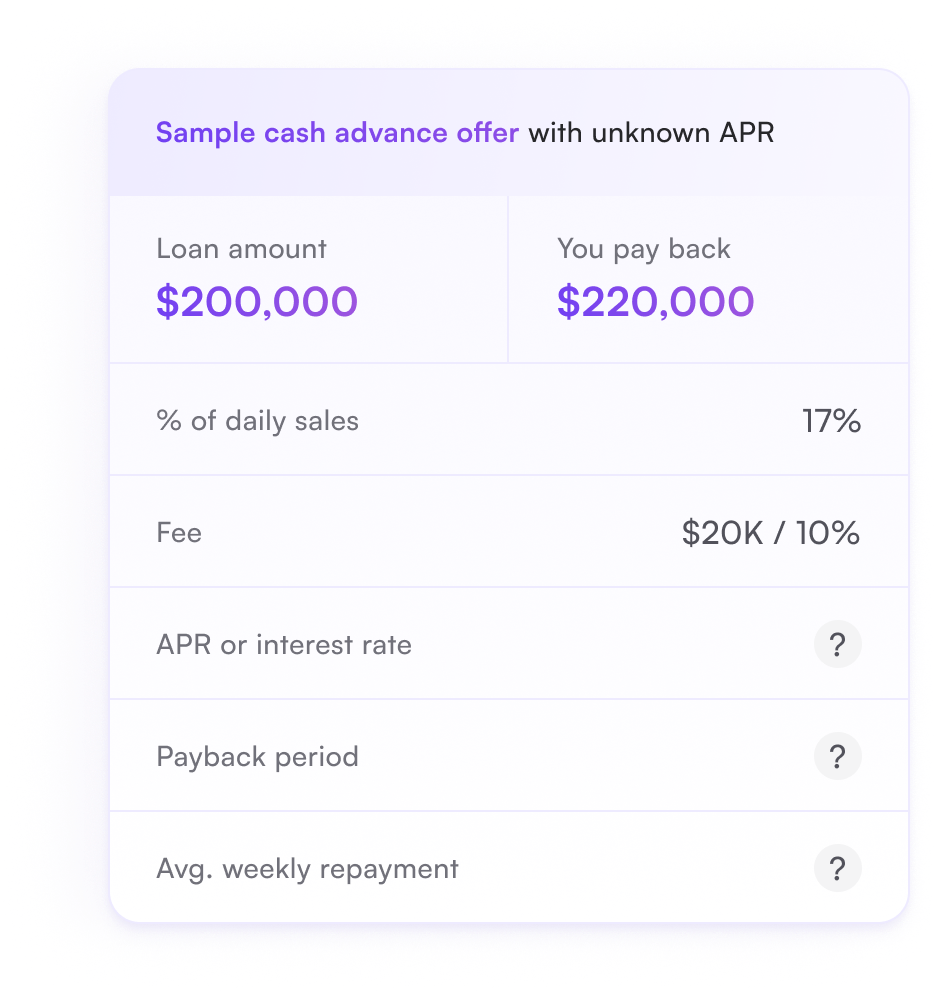

Calculate APR and payback on your cash advance offer

Never take a loan without understanding its true cost and impact to your cash flow.

Built by Highbeam

Lenders measure their return and risk with an APR. We leveled the playing field so you can too.

Understand and compare the real cost of a fee-based loan.

.png)

Annual percentage rate (APR) is a fair comparison of total cost of a loan to another. The APR provides business owners with a bottom-line number they can compare among lenders, credit cards, or investment products.

A merchant cash advance or MCA is a loan where a business is offered an advance for a fee in return for a percentage of sales. Typically the fee is fixed while the payback schedule varies.

The key variable to determine APR is the projected sales which will be used to pay back the loan. We use sales estimates to calculate the estimated daily payback amounts and therefore the APR.